When it comes to finances, things like travel or entertainment budgets often steal the show. But have you ever thought about making a health budget? A health budget can help you allocate funds that may otherwise be going to a daily coffee or a spring dress toward health priorities you may be neglecting due to the price tag feeling too high. If you're looking for ways to prioritize your health and gain a better understanding of where your money is going, it may be time to give a health budget a go.

Understandably, the idea of a health budget might seem overwhelming. But with the right techniques, it can be a crucial tool in your wellness journey.

1. Establish your health goals.

A successful health budget calls for clearly defined goals. After all, when you have objectives in place, it will be easier to divert your cash toward healthier behaviors. Be specific, too. For example, instead of aiming to “eat more vegetables,” strive to “eat a vegetable at every meal” or “try a new vegetable every week.” Compared to more general goals, these specific objectives will strengthen your path toward health-focused habits.

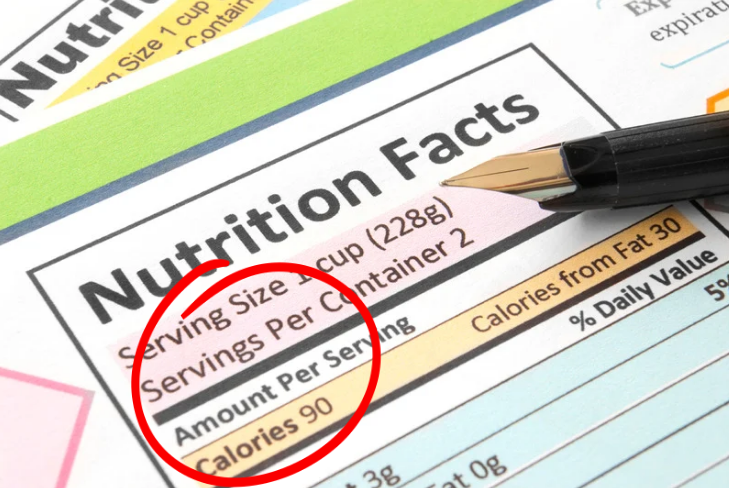

2. Understand your health expenses.

In order to create a budget, you need to know your basic health expenses. This might include costs such as prescription drugs, supplements, groceries, gym memberships and health insurance premiums. By identifying this monthly number, you’ll understand how your basic health needs play into your overall budget.

3. Make the most of your health plan.

One of the best ways to make and maintain a health budget is to use your insurance plan to its fullest potential. That’s because it includes preventive care, which can prevent costly treatments and therapies in the future. Most health insurance plans also offer incentives and discounts on wellness products, apps, memberships and services. Educate yourself on all your insurance has to offer and, over time, these perks can help structure your budget while reducing your health expenses.

4. Track your spending.

This is key for creating budgets in general. When it comes to wellness, though, tracking will pinpoint any spending habits that hinder your health goals. For example, let’s say you tend to buy lunch on the go. Tracking your lunch expenses can help highlight where you might be overspending, giving you a chance to re-evaluate your habits. From there, you can find opportunities to save money on lunch and redirect cash toward health-related priorities.

5. Buy second-hand fitness equipment.

Remember, you don’t need a shiny new contraption to stay active. Consider purchasing used gym equipment, like stationary bikes or dumbbells, whenever possible. Check out garage sales, Facebook Marketplace or Craigslist. You can also search for “used fitness equipment” or “used gym equipment” on Google to find local specialty stores.

6. Check if you qualify for gym discounts.

If a gym setting is more your style, consult your health plan first. Your insurance provider might offer special rebates at certain gyms. Similarly, many gyms have cheaper fees for students, teachers, senior citizens or military personnel. If you check any of these boxes, look for a gym that offers membership discounts.

7. Follow workouts on YouTube.

YouTube might very well be your wallet’s best friend. It’s an indispensable source for free workout routines, making it easy to stay active on the cheap. Moreover, YouTube is home to thousands (and thousands) of instructors, so you’re sure to find something that suits your interests. Just be sure to seek out qualified, experienced instructors that cater to your specific fitness level, rather than influencers parading as experts.

8. Plan your meals in advance.

Before trekking to the supermarket, take a few minutes to break down your meals for the next week or so. Even better, build your dishes around sales and what you already have on hand. With this method, you’ll be able to plan more mindful meals, solidify a realistic budget and put extra dollars toward other health expenses.

The next time you think "healthy living is too expensive", remember that a little planning can go a long way to ensure your dollar goes farther.